Bond System

Overview of Bond Protocol's smart contract architecture

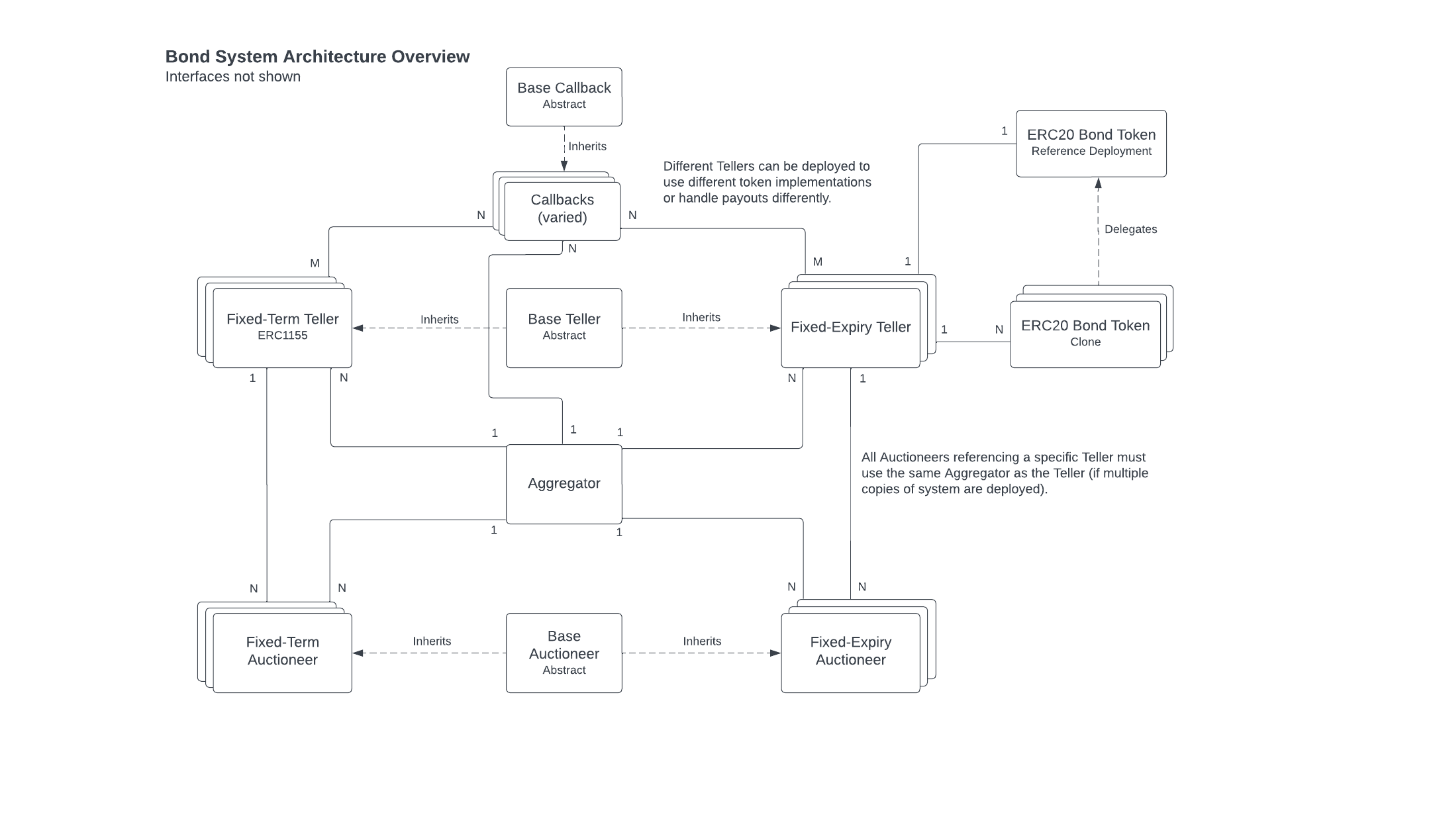

Bond Protocol is a system to create OTC markets for any ERC20 token pair with optional vesting of the payout. The markets do not require maintenance and will manage bond prices per the methodology defined in the specific auctioneer contract. Bond issuers create markets that pay out a Payout Token in exchange for deposited Quote Tokens. If payouts are instant, users can purchase Payout Tokens with Quote Tokens at the current market price and receive the Payout tokens immediately on purchase. Otherwise, they receive Bond Tokens to represent their position while their bond vests. Once the Bond Tokens vest, they can redeem it for the Quote Tokens. The type of Bond Token received depends on the vesting type of the market: Fixed Expiry (all purchases vest at a set time in the future) -> ERC20, Fixed Term (each purchaser waits a specific amount of time from their purchase) -> ERC1155.

Bond Protocol is comprised of 3 main types of contracts:

Auctioneers - Store market data, implement pricing logic, and allow creators to create/close markets

Tellers - Handle user purchases and issuing/redeeming of bond tokens

Aggregator - Maintains unique count of markets across system and provides convenient view functions for querying data across multiple Auctioneers or Tellers

Last updated