Fixed Strike oTokens

ERC20-compatible option token implementation with fixed strike prices

Overview

Option Tokens (oTokens) are issued by a Option Teller to represent American-style options on the underlying token. Call option tokens can be exercised for the underlying token 1:1 by paying the amount * strike price in the quote token at any time between the eligible and expiry timestamps. Put option tokens can be exercised for the underlying token 1:1 by paying the amount of the underlying token to receive the amount * strike price in the quote token at any time between the eligible and expiry timestamps.

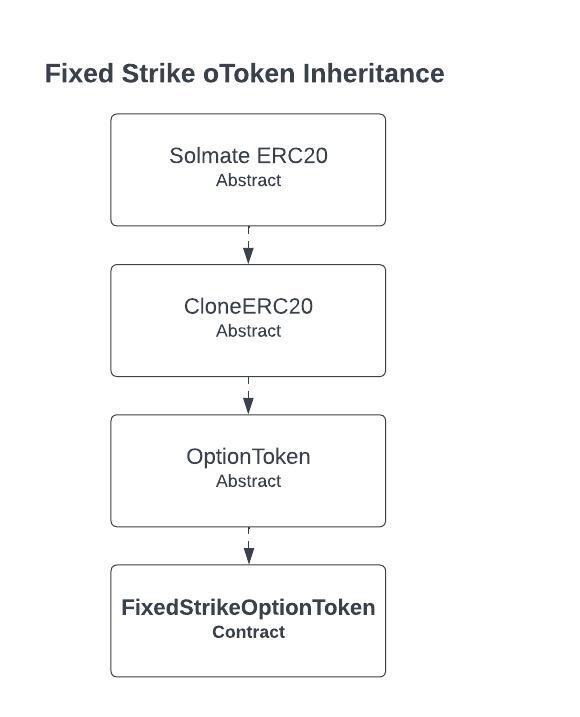

The Fixed Strike Option Token contract is a specific implementation of oTokens where the strike price is specified and fixed on creation.

oTokens are unique to the combination of parameters that they are deployed with. Eligible and expiry timestamps are rounded down to the nearest day (using UTC) to reduce the possible number of tokens.

This contract uses Clones With Immutable Args to save gas on deployment and is based on VestedERC20.

FixedStrikeOptionToken Contract

Immutable Args

payout

The token that the option is on

quote

The token that the option is quoted in

eligible

Timestamp at which the Option token can first be exercised

expiry

Timestamp at which the Option token cannot be exercised after

receiver

Address that will receive the proceeds when option tokens are exercised. Also, the only address that can reclaim collateral from expired oTokens.

call

Whether the option is a call (true) or a put (false)

teller

Address of the Teller that created the token

strike

The strike price of the option (in quote token units)

Functions

mint

Mint option tokens

Only callable by the Teller that created the token

Parameters

to

address

The address to mint to

amount

uint256

The amount to mint

burn

Burn option tokens

Only callable by the Teller that created the token

Parameters

from

address

The address to burn from

amount

uint256

The amount to burtn

getOptionParameters

Get collection of option parameters in a single call

Returns

decimals_

uint8

The number of decimals for the option token (same as payout token)

payout_

ERC20

The address of the payout token

quote_

ERC20

The address of the quote token

eligible_

uint48

The option exercise eligibility timestamp

expiry_

uint48

The option exercise expiry timestamp

receiver_

address

The address of the receiver

call_

bool

Whether the option is a call (true) or a put (false)

strike_

uint256

The option strike price specified in the amount of quote tokens per underlying token