Oracle Sequential Dutch Auctioneer (OSDA)

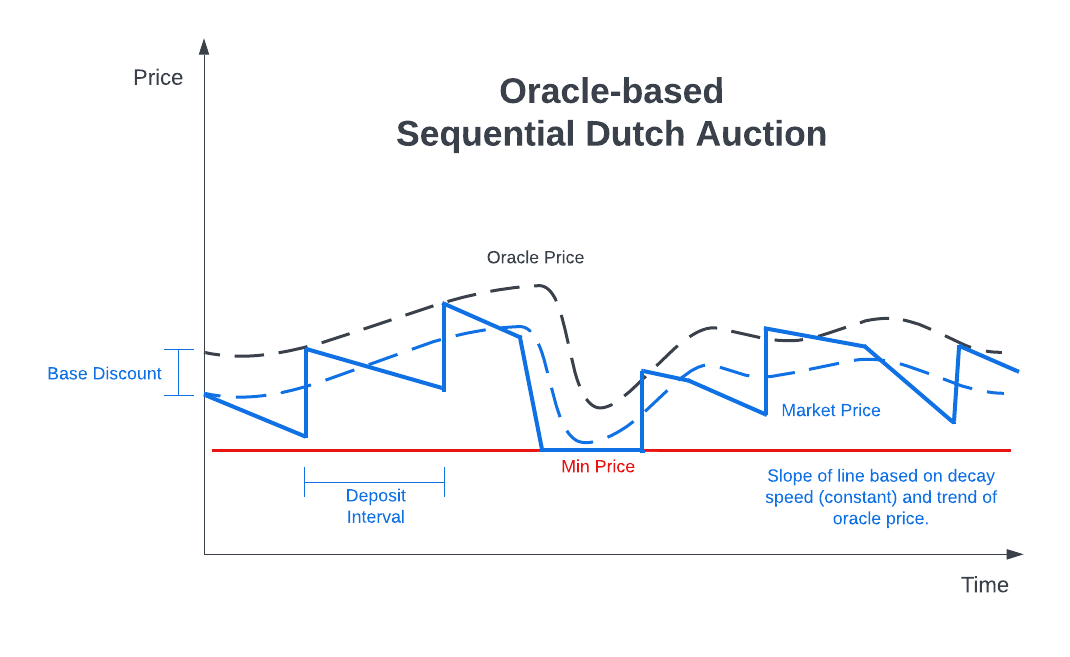

The Oracle Sequential Dutch Auctioneer implements a simplified sequential dutch auction pricing methodology which seeks to sell out the capacity of the market linearly over the duration. We do so by implementing a linear decay of price based on the percent difference in expected capacity vs. actual capacity (relative to the initial capacity) at any given point in time. The OSDA allows specifying a base discount from the oracle price and calculates a decay speed based on a target deposit interval and target discount over that interval. More specifically, we define the price as:

P(t)=O(t)×(1−b)×(1+k×r(t))

where O(t) is the oracle price at time t, b is the base discount percent of the market, k is the decay speed, and r(t) is the capacity ratio.

We calculate k on market creation as:

k=IdL×d

where L is the duration of the market, Id is the deposit interval, and d is the target discount over a deposit interval.

We calculate the capacity ratio as:

r(t)=C0χ(t)−C(t)

where C0 is the initial capacity of the market, C(t) is the remaining capacity at time t, and χ(t)=C0×LL−t is the expected capacity at time t.

Market creators can also set a minimum total discount from the starting price, which creates a hard floor for the market price.

The below chart shows a notional example of how price might evolve over an OSDA market.

If you're familiar with other dutch auction mechanism designs, this version of the SDA is similar to Paradigm's Continuous Gradual Dutch Auction (GDA) model with linear decay, but there is no price slippage based on the purchase amount. Note the version described in the link above uses exponential decay vs. linear decay, but it's possible to derive a linear decay version as well.

Configuring appropriate base discount and target interval discounts is a function of the market demand for the token and the vesting period of the payouts. Typically, longer vesting periods require a larger base discount. Target interval discounts may need to be higher for smaller cap tokens or where demand is soft. However, various combinations can be used depending on desired market characteristics. For example, a high base discount and low target interval discount will give a consistently good deal with low volatility in the market price. The opposite configuration, low base discount and high target interval discount, will be more volatile, but may result in lower overall discounts depending on demand.

Data Structures (Structs)

MarketParams

Parameters to create a new OSDA market. Encoded as bytes and provided as input to createMarket.

payoutToken

ERC20 (address)

Payout Token (token paid out by market and provided by creator)

quoteToken

ERC20 (address)

Quote Token (token to be received by the market and provided by purchaser)

callbackAddr

address

Callback contract address, should conform to IBondCallback. If 0x00, tokens will be transferred from market owner. Using a callback requires whitelisting by the protocol

oracle

IBondOracle (address)

Oracle contract address, must conform to IBondOracle. Provides current price data for the quote/payout token pair.

baseDiscount

uint48

Base discount from oracle price before time-related decay is applied. Units are a percent with 3 decimals of precision (e.g. 10_000 = 10%)

maxDiscountFromCurrent

uint48

Max Discount (%) from the oracle price when the time the market is created. Sets a minimum price for the market. Units are a percent with 3 decimals of precision (e.g. 10_000 = 10%).

targetIntervalDiscount

uint48

The discount from zero to be achieved over a depositInterval if no purchases are made during that time. Controls the decay speed of the market price. Applied after the base discount. Units are a percent with 3 decimals of precision (e.g. 10_000 = 10%)

capacityInQuote

bool

Is Capacity in Quote Token?

capacity

uint256

Capacity (amount in quote token decimals or amount in payout token decimals). Set capacityInQuote flag appropriately.

depositInterval

uint48

Target deposit interval for purchases (in seconds). Determines the maxPayout of the market. Minimum is 1 hour (3600 seconds)

vesting

uint48

Is fixed term ? Vesting length (seconds) : Vesting expiry (timestamp). A 'vesting' param longer than 50 years is considered a timestamp for fixed expiry

start

uint48

Start time of the market as a timestamp. Allows starting a market in the future. If provided, the transaction must be sent prior to the start time. If not provided, the market will start immediately.

duration

uint48

Duration of the market in seconds.

BondMarket

BondMarket contains the token, callback, capacity, owner, and purchased/sold amount data for a Oracle Fixed Discount Market.

BondTerms

BondTerms contains the oracle, pricing, and time parameters of an Oracle Fixed Discount Market.

Public Variables and View Methods

allowNewMarkets

Whether or not the auctioneer allows new markets to be created

Changing to false will sunset the auctioneer after all active markets end

authority

Roles authority contract for the bond system which managed access-control to permissioned functions.

callbackAuthorized

Whether or not the market creator is authorized to use a callback address

Parameters

creator_

address

Market creator address.

currentCapacity

Returns current capacity of a market

Parameters

id_

uint256

Market ID

getAggregator

Returns the Aggregator that services the Auctioneer

getMarketInfoForPurchase

Provides information for the Teller to execute purchases on a Market

Parameters

id_

uint256

Market ID

Returns

owner

address

Address of the market owner (tokens transferred from this address if no callback)

callbackAddr

address

Address of the callback contract to get tokens for payouts

payoutToken

contract ERC20

Payout Token (token paid out) for the Market

quoteToken

contract ERC20

Quote Token (token received) for the Market

vesting

uint48

Timestamp or duration for vesting, implementation-dependent

maxPayout_

uint256

Maximum amount of payout tokens you can purchase in one transaction

getTeller

Returns the Teller that services the Auctioneer

isInstantSwap

Does market send payout immediately

Parameters

id_

uint256

Market ID

isLive

Is a given market accepting deposits

Parameters

id_

uint256

Market ID

marketPrice

Calculate current market price. Value returned is the number of quote tokens per payout token. The value is the oracle price scaled by the BondTerms.oracleConversion factor. marketPrice and marketScale can be used to convert between amounts of quote tokens and payout tokens at the current price.

Parameters

id_

uint256

Market ID

marketScale

Scale value to use when converting between quote token and payout token amounts with marketPrice()

Parameters

id_

uint256

Market ID

markets

Returns the token, callback, capacity, owner, and purchased/sold amount data for a market. See BondMarket.

Parameters

id_

uint256

Market ID

maxAmountAccepted

Returns maximum amount of quote token accepted by the market

Parameters

id_

uint256

Market ID

referrer_

address

Address of referrer, used to get fees to calculate accurate payout amount. Inputting the zero address will take into account just the protocol fee.

maxPayout

Calculate max payout of the market in payout tokens

Returns a dynamically calculated payout or the maximum set by the creator, whichever is less. If the remaining capacity is less than the max payout, then that amount will be returned.

Parameters

id_

uint256

Market ID

minDepositInterval

Minimum deposit interval for a market

minMarketDuration

Minimum market duration in seconds

newOwners

New address to designate as market owner. They must accept ownership to transfer permissions.

Parameters

id_

uint256

Market ID

ownerOf

Returns the address of the market owner

Parameters

id_

uint256

Market ID

payoutFor

Payout due for amount of quote tokens at current market price

Parameters

amount_

uint256

Amount of quote tokens to spend

id_

uint256

Market ID

referrer_

address

Address of referrer, used to get fees to calculate accurate payout amount. Inputting the zero address will take into account just the protocol fee.

terms

Information pertaining to oracle, pricing, and time parameters. See BondTerms.

Parameters

id_

uint256

Market ID

State-Mutating Methods

closeMarket

Disable existing bond market. Must be market owner

Parameters

id_

uint256

Market ID

createMarket

Creates a new bond market

See MarketParams for the required formatting for the abi-encoded input params.

Parameters

params_

bytes

Configuration data needed for market creation, encoded in a bytes array

Returns

id_

uint256

Market ID

pullOwnership

Accept ownership of a marketMust be market newOwner

The existing owner must call pushOwnership prior to the newOwner calling this function

Parameters

id_

uint256

Market ID

purchaseBond

Exchange quote tokens for a bond in a specified market. Must be teller. End users interact with the Teller contract to purchase.

Parameters

id_

uint256

Market ID

amount_

uint256

Amount to deposit in exchange for bond (after fee has been deducted)

minAmountOut_

uint256

Minimum acceptable amount of bond to receive. Prevents front-running

Returns

payout

uint256

Amount of payout token to be received from the bond

pushOwnership

Designate a new owner of a marketMust be market owner

Doesn't change permissions until newOwner calls pullOwnership

Parameters

id_

uint256

Market ID

newOwner_

address

New address to give ownership to

setAllowNewMarkets

Change the status of the auctioneer to allow creation of new markets

Setting to false and allowing active markets to end will sunset the auctioneer

Parameters

status_

bool

Allow market creation (true) : Disallow market creation (false)

setCallbackAuthStatus

Change whether a market creator is allowed to use a callback address in their markets or not. Must be guardian

Callback is believed to be safe, but a whitelist is implemented to prevent abuse

Parameters

creator_

address

Address of market creator

status_

bool

Allow callback (true) : Disallow callback (false)

setMinDepositInterval

Set the minimum deposit interval. Access controlled

Parameters

depositInterval_

uint48

Minimum deposit interval in seconds

setMinMarketDuration

Set the minimum market duration. Access controlled

Parameters

duration_

uint48

Minimum market duration in seconds

Events

MarketClosed

Parameters

id indexed

uint256

Market ID

MarketCreated

Parameters

id indexed

uint256

Market ID

payoutToken indexed

address

Address of the payout token

quoteToken indexed

address

Address of the quote token

vesting

uint48

Vesting duration or timestamp

Errors

The following custom errors are used in the OSDA contract to denote specific revert conditions. The errors are prefixed with "Auctioneer" to denote that it is within this contract when multi-contract actions are performed (such as buying a bond).